Image via Wikipedia

Image via Wikipedia

I honestly don't think I'll ever buy another one of his books. When I find someone this disgusting, I don't want my money to line their pockets.

Disappointing.

http://www.mormontimes.com/mormon_voices/orson_scott_card/?id=1586

(in which author Orson Scott Card takes the arch-conservative position that gays can't be married).

My response:

..But not surprising. Card is a Mormon; he's echoing his church's position - which is also the Catholic Church's position. There are lots of people who feel this way. Changing the law won't change their minds; they'll just organize until, this being an approximate democracy, they change it back. And so it will go, back and forth, back and forth, as various faction seize government power to enforce their view.

Image via Wikipedia Jewish marriage contract specifying duties of each partner

Image via Wikipedia Jewish marriage contract specifying duties of each partner

The only intelligent thing Card says in his diatribe is this: "The laws concerning marriage did not create marriage, they merely attempted to solve problems in such areas as inheritance, property, paternity, divorce, adoption and so on." Actually, this is true, or it should be true. IMHO, the state should not "define" marriage, or otherwise involve itself in this fundamentally religious concept. It should only establish legal requirements, obligations, and rights among people who choose to engage in a union of this kind. Leave the arguments over "marriage" to the churches, for those who care so much about it.

Image by Getty Images via Daylife

Image by Getty Images via Daylife

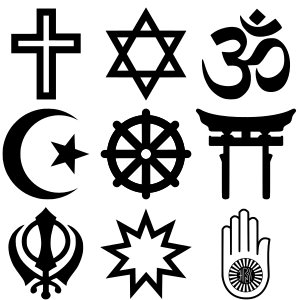

This is just another area where the government should get itself out of religion; it cannot be resolved by law -- people's minds can't be changed by majority rule. Back in the before time, the religious busied themselves demanding the government take sides in deciding which was the True Religion, and which therefore deserved legal benefits denied other religions (or nonreligions) including tax support. This argument went on for centuries and was only resolved when the government got out of the business of religion. It's still a problem in other parts of the world where religious fanatics demand the government take sides. Preferably their side. We cannot win a war defined in this way; so we have to do what the Founders did: change the definition of the war.

Image via Wikipedia

Image via Wikipedia

Civil unions for all; marriage for the churches; peace and quiet for the rest of us.

mac

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_a.png?x-id=46faee60-9146-4672-be8d-7d8c7a0d0204)